Wine Bottle Sizes: Everything you Need to Know

When it’s time to celebrate, the large wine bottle size you choose—from magnum to nebuchadnezzar—could be more important than you think

When it’s time to celebrate, the large wine bottle size you choose—from magnum to nebuchadnezzar—could be more important than you think

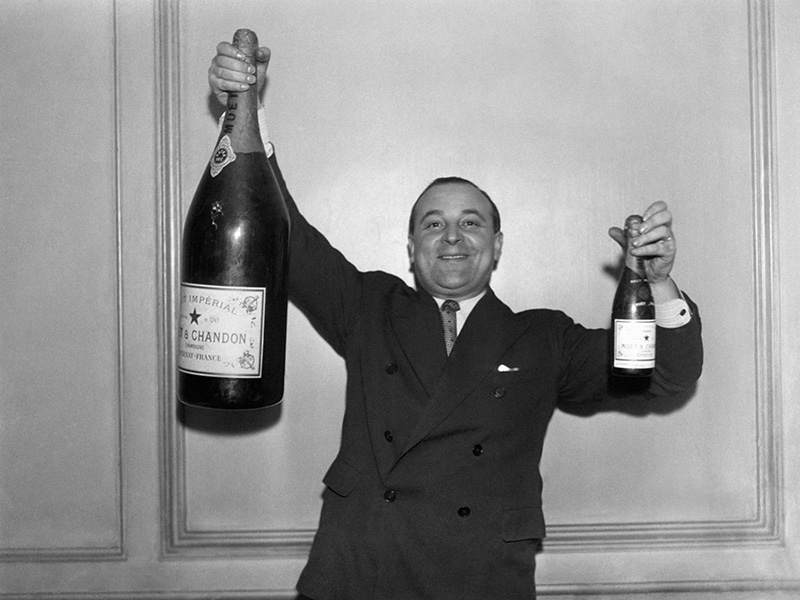

The candles are lit, the table is set, and it’s time for the wine. But why waste hours opening bottle after bottle when you could pop a single cork and pour for the whole table? In the world of fine wine, there’s nothing more special than extra-large bottles, which not only set the scene for celebration, but offer an inimitable experience for guests and hosts alike. Luxury Defined presents a guide to wine bottle sizes.

Popularized in Bordeaux, where the history of the magnum (equivalent to two standard bottles of wine) and larger bottles dates back to the 1800s, extra-large bottles do more than add pizzazz to intimate dinners and extraordinary parties. A spectacle whenever they’re shared, these wines are the ultimate investment in pleasure: ideal for entertaining now, cellaring over the long term, or holding as liquid assets.

“Large formats not only age better, but they are the very best way to celebrate in great company,” explains Jean-Guillaume Prats, chief executive of Domaines Barons de Rothschild, which operates the First-Growth estate Château Lafite Rothschild as well as Pomerol’s Château L’Évangile and Chile’s 100-point scoring Almaviva winery. “The wines from large formats tend to be fresher,” explains Prats. “The fruit would be exploding, even more so if the vintage has some maturity.”

These bottles have their unique size to thank for their advantages in the cellar: as wine ages, its flavors and aromas evolve from fresh, ripe fruit, and powerful spices to reveal subtle, secondary aromas as minute amounts of oxygen move through the cork. In large bottles, where there is more wine relative to the air that seeps through the cork, that development is slower, preserving the wine’s character and freshness.

“You can really taste the difference,” explains Edwin Vos, Head of Wine, Continental Europe at Christie’s, who recommends opening standard bottles alongside magnums and double magnums when possible. “In a 10-year-old wine you’ll see a distinctive difference in the development.”

Vos also notes large bottles are an excellent investment, whether for personal cellaring or for resale. “Because of their slower development, a large bottle from a known producer is more valuable than a standard bottle,” he explains, citing recent Christie’s auctions where magnums of 1986 Château Lafite Rothschild fetched more than $2,000 each.

In Champagne, the aging regimen for large-format bottles is even more pronounced. Here, producers are legally required to age the wine in its original bottles, ensuring extra-large bottles receive extra attention from winemakers. As a result, champagne magnums offer a dazzling level of complexity and value.

“When you are a champagne geek, magnums are the best format for appreciating the true aromatic profile of the wine,” explains Willem Pinçon of Charles Heidsieck. “Magnums provide the perfect balance of age, oxidation, and reduction.”

Pinçon points out that this process is required for magnums and double magnums (jeroboams) only, and that larger bottlings are simply the equivalent of standard bottles poured into one large, eye-catching bottle. This fall, Charles Heidsieck is releasing its last cache of jeroboams of the Charles Heidsieck Collection Crayères Brut Millésime 1989 vintage bubbly, a stellar wine that is glowing with flavor, even at 30 years old.

These centerpieces have soared in popularity in recent years, and are now commonplace among the best wine regions in the world. In Napa Valley, winemaker Dan Petroski of Larkmead puts their rise in popularity simply: “Large formats are fun! If wine is to be shared, which it should be, sharing a larger-format bottle with family and friends is attention-grabbing and generous.” Despite their giant size, these bottles don’t demand a huge party to be opened and enjoyed. “Instead of opening a few bottles for a dinner of four or more, open a magnum or a double magnum,” says Vos.

At 1.5 liters, a magnum contains 10 servings of wine, or about two glasses per person. Jeroboams, which hold three liters, are also ideal for smaller gatherings, while bottles go up in size to 20-liter behemoths known as nebuchadnezzars, ideal for larger festivities.

When serving, Petroski suggests decanting, as well as preparing the wine long before it is served. “Don’t be afraid to stand the wine up for a couple of days in your cellar before you plan to open it,” he says. For large bottles with decorative wax seals, insert the corkscrew directly in the center of the bottle, through the wax. Wipe the neck of the bottle before pouring. Then, use both hands to hold the bottle. Pinçon’s advice is straightforward when it comes to elegantly serving enormous bottles: “You probably need a good friend.” Luckily, if magnums are on the menu, thirsty friends won’t be hard to find.