Supply Dynamics Impact Luxury Housing Demand

A look into how long it takes to sell million-dollar-plus home around the world and how new luxury housing inventory has an impact on property prices

A look into how long it takes to sell million-dollar-plus home around the world and how new luxury housing inventory has an impact on property prices

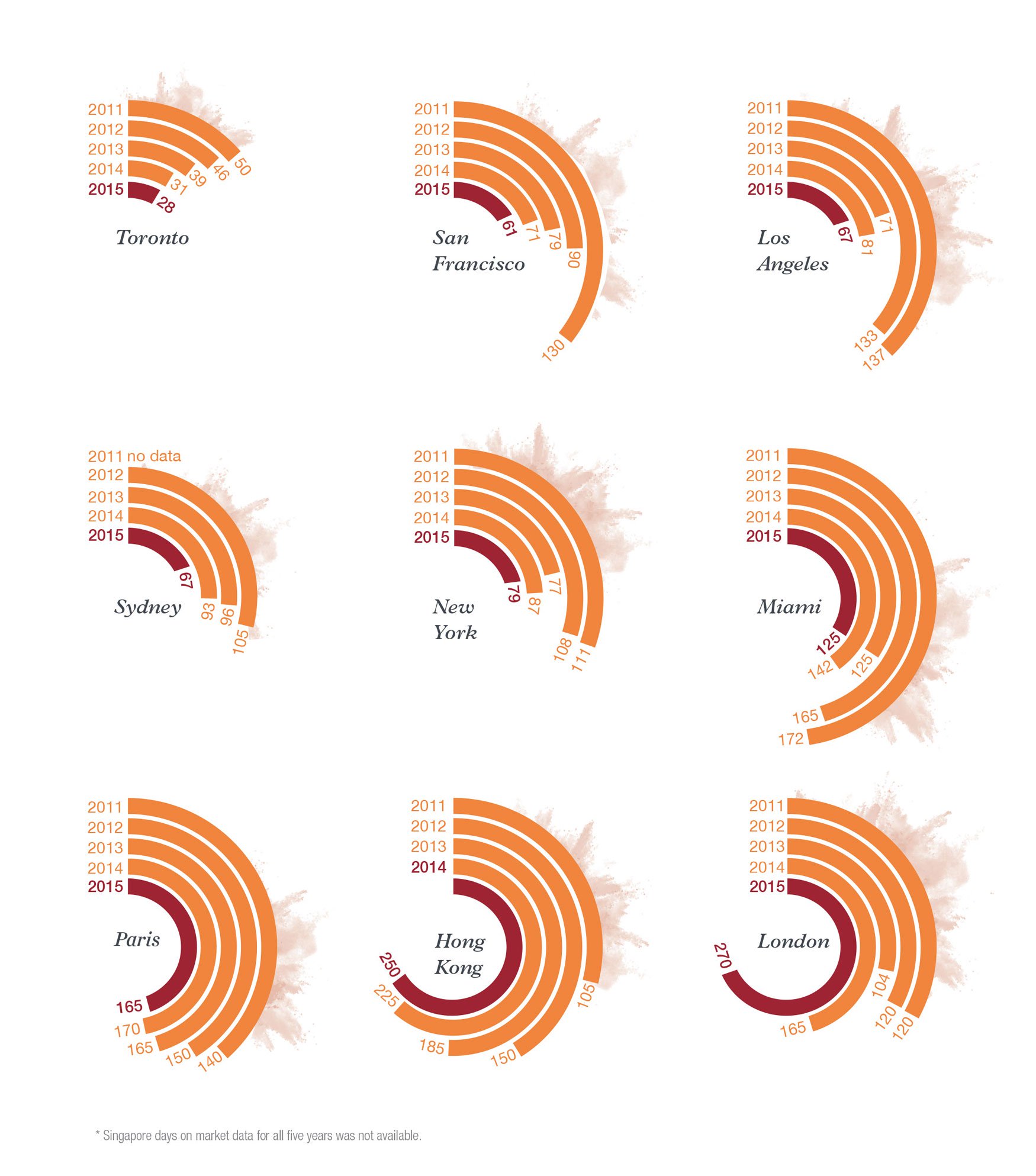

In the majority of luxury housing markets surveyed for our 2016 Luxury Defined report on the worldwide high-end real estate market, it took either the same or in some cases significantly less time to sell a luxury property in 2015 as compared to the year prior. On average, US$1 million-plus homes worldwide stayed on the market for 195 days, a 23 percent drop from 2014.

Limited supply remains a constraining factor in many luxury residential markets. As the International Monetary Fund observed in a January 2016 report, “Inelastic supply of housing contributes to magnifying the impact of shocks to housing demand.” A shortage of quality luxury stock in Sydney is “lessening the impact of the market softening in other price points,” says Ken Jacobs of Ken Jacobs in Australia.

The imbalance between demand and supply has helped limit price falls in some markets yet has pushed prices higher in others. “The problem with these low inventory levels, aside from the fact that they leave buyers frustrated, is that they are placing incredible upward pressure on sale prices,” notes Chris Kapches of Chestnut Park Real Estate in Toronto, where home prices increased by 14 percent from January 2015 to January 2016. Renee Grubb of Village Properties in California’s seaside community of Santa Barbara, concurs: “The gradual rise in prices and lack of inventory provided a seller’s market, and left buyers feeling they needed to buy before being priced out of the market.”

Luxury homes worldwide on average took 195 days to sell in 2015

Market attractiveness, coupled with inventory issues, impacted the time it took to sell a luxury home in the world’s top cities for luxury property (see chart below). Markets that saw sharp declines in time on market also saw a correlation in sales volume growth: Sydney went from 93 days on market to 67 in 2015, Paris dropped to 165 days from 170.

Conversely, London and Hong Kong saw year-on-year increases in the time it took to sell a luxury home in 2015, corresponding with a slowdown in overall demand.

Years of record-breaking price increases, bidding wars due to limited luxury inventory, and strong international buyer interest resulted in a flurry of new ultra-luxurious buildings

from developers eager to capitalize on ever-growing demand. 2015 was the apex of the new development blitz globally. The world’s 100th “super tall” skyscraper opened in New York this January, following the development of more than 50 skyscrapers between 2010-2015, many outfitted with ultra-luxury apartments.

After a five-year housing shortage in New York, over 6,500 new units hit the market in 2015, the largest influx of new stock since the global financial downturn. Much of this stock was high-value “super luxury” condos. While Manhattan apartment prices smashed records in 2015, sales of $10 million-plus residences slowed by 14 percent in the same period, with much of the decline in the second half of the year.

A similar story unfolded in Miami, where the launch of new prime developments in 2015 bolstered inventory, but a decline in overseas buyer demand caused luxury market sales to slow. “It’s not something to be alarmed about yet, but there’s no question that we’re going to see values level out,” says Ron Shuffield of EWM Realty International. “We’re advising our sellers to be patient; it might take a little bit longer to sell.”

In London, new residential developments have successfully contributed to ameliorating the inventory shortage without overwhelming the market. “Our most exclusive residential development schemes in prime central London continue to attract significant attention

and high prices, while the secondhand market hasn’t demanded the same kind of response,” notes Lulu Egerton of Strutt & Parker.